Northern Ireland Weekly Market Report

6 July 2020

Wheat

While there has been recent support from reduced grain production forecasts the outlook for wheat remains well supplied for 2020/21. Southern Hemisphere crops look to be key to the outlook this coming season.

Maize

Cuts to the US production outlook last week following the acreage report, but the demand outlook remains weak for ethanol. Weather will be a key swing factor for maize markets.

Barley

Advertisement

Advertisement

The barley outlook continues to look well supplied globally and barley will need to maintain a discount to wheat in order to remain competitive into rations.

Global markets

Global grain prices received a sharp boost last week, particularly maize. Prices moved higher following the release of the USDA acreage report last Tuesday; maize plantings are estimated at 37.2Mha, down 2.0Mha from March’s intentions survey.

If we see trend yields and abandonment, the US could still be set for a record crop. With a reduced crop area, weather again becomes an important swing factor for maize markets, particularly with the crop now silking.

The weather forecast in the US Corn Belt is trending hotter and drier over the next fortnight, which could support Chicago corn prices at the levels reached last week.

Advertisement

Advertisement

Wheat prices received less support than maize despite the cuts to US wheat planting estimates. The wheat picture continues to look better supplied year-on-year, with Southern Hemisphere supplies expected to offset cuts in the US, EU and Ukraine.

There was also some support for wheat from a reduction to the Russian crop outlook. Analyst firm SovEcon reduced its estimate of 2020/21 wheat production by 1.8Mt to 80.9Mt. Further suggestions of tightness in global trade for the second half of 2020/21 have been mooted; with Russia’s agriculture minister suggesting the nation could make its April-June quota a permanent feature of grain markets.

UK focus

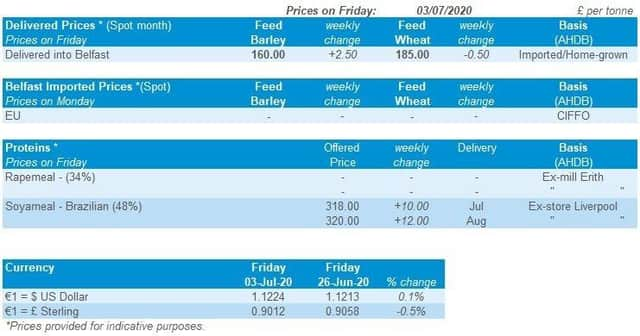

UK grain markets followed the global trend last week, albeit dampened slightly by the strength in sterling. Sterling was up 0.94% against the euro between Friday 26 June and Friday 3 July. UK feed wheat futures gained £3.70/t Friday-Friday, closing at £166.70/t on 3 July.

UK delivered markets were up marginally on the week, this reflects the midweek fall in grain futures, with the Nov-20 futures contract closing on Thursday 2 July at £165.00/t.

Advertisement

Advertisement

Delivered milling wheat premiums over futures (spot, North West) remain strong at £38.50/t. UK delivered feed wheat premiums also remain strong in a thin market.

The UK Planting and Variety survey results will be published on Wednesday 8 July at 2pm.

The latest Daily and Weekly futures settlement prices reports are now available on the website.

Oilseeds

Rapeseed

Support for oilseed rape this week has been off the back of soyabean markets and the slight uptick in support for crude oil. Longer term this market is forecast to be well supplied as we start the 2020/21 marketing year.

Soyabeans

Advertisement

Advertisement

The soyabean market was supported last week. However, there is still a bearish outlook as we head into the next marketing year, with plentiful supplies forecast. However, weather conditions in the US must be observed closely.

Global markets

US soybean futures (Nov-20) closed on Thursday at $329.50/t, up $13.04/t on the Friday before (26 June). The soyabean market was supported last week as the USDA only slightly revised US soyabean plantings, up by 0.1Mha, with the total area now at 33.92Mha.

The market had expected a larger switch to soyabeans as the area figure still stands 0.6% below the 5-year-average. Furthermore, soyabean markets are supported at the start of this week as there are concerns of hot and dry weather across the US Midwest over the next two weeks.

Chicago soy oil futures (Dec-20) also shadowed the gain seen in soyabean futures to close Thursday at $633.83/t, gaining $14.77/t across the week.

Advertisement

Advertisement

Malaysian palm oil futures (Sep-20) were down 0.42% across the week (Friday to Friday). However, this morning this contract was supported off the back of soyoil markets and on prospects of lower than expected June inventories from increased exports.

Some support in energy markets is also driving support for edible oil prices. Nearby Brent crude oil closed Friday at $42.76/barrel, up $1.74/barrel across the week, supported by tightening supplies as the global economy restarts.

The latest Daily and Weekly futures settlement prices reports are now available on the website.

Rapeseed focus

In Canada, the latest Alberta crop condition report rated 76% of canola good to excellent. This is quite bearish news as Canada is forecast to produce a large canola crop in 2020/21.

Advertisement

Advertisement

Paris rapeseed futures (Nov-20) closed Friday at €378.50/t, up €1.75/t across the week. Support for soyabeans and slight upticks in energy offered some support to rapeseed.

UK rapeseed delivered into Liverpool was quoted Thursday at £335.50/t, down £0.50/t across the week. Our domestic market was unable to encapsulate this gain as sterling strengthened against the euro by 0.94% (Friday-Friday) to close Friday at £1 = €1.1096.