Northern Ireland weekly market report

and live on Freeview channel 276

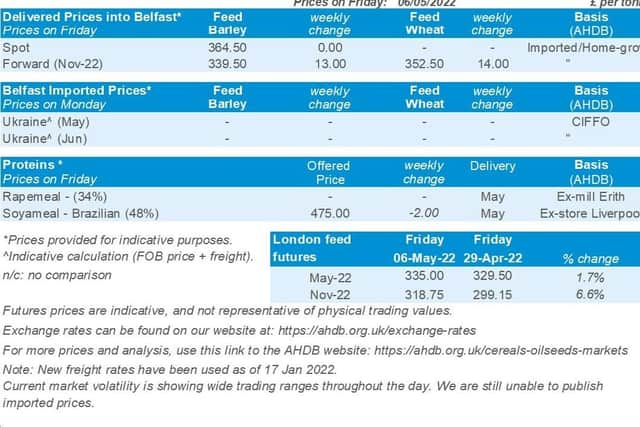

Grains

Wheat - Tight global supply and demand keeps prices at historical highs. Dry conditions are adding to concerns for harvest 22, though the Russian crop looks large. In the UK, wheat held on farm is up 45% year-on-year.

Maize - Global maize supply remains tight. US planting delay and Brazilian dryness remain two key watchpoints. Can demand be sustained at these high prices?

Advertisement

Advertisement

Barley - The global and domestic barley market remains tight, further supported by firm wheat and maize prices.

Global markets

A tight global supply picture for wheat continues to support global prices. Though grains saw some technical selling on Friday, as prices reach historical highs.

India has downgraded their wheat crop, with the government trimming forecasts by 6.3Mt to 105.0Mt. This is due to very high temperatures in March, cutting yields. After five consecutive years of record wheat harvests, this comes as a shock to the market considering India’s recent ability to fill a supply gap.

French grain crops too are a concern for trade. Hot and dry weather this week in France, will reportedly cause irreversible damage to grain crops according to technical institute Arvalis. This follows months of not enough rainfall.

Advertisement

Advertisement

Weather remains a key driver for markets. In the US, there are hopes that crop planting can progress this week. Some rain is forecasted, though for many areas, rain will be below average. Dry periods may help planting progress for maize particularly. The latest report is due this evening, detailing US crop progress.

Brazil conditions remain warm and dry across much of the growing Safrinha maize region. However, rain could arrive mid-May. Something to watch.

As at end of March 2022, Canadian field crop stocks were lower than March 2021, notably for total wheat (-38.7%), barley (-43.7%), and oats (-48.6%). Lower supplies are down to lower production in 2021, caused by drought conditions.

However, Russia continues to fulfil global demand with competitively priced wheat. On Friday, the SovEcon consultancy raised their forecast for Russian exports 2021/22 by 0.2Mt, to 34.1Mt. A Russian wheat export cap remains, to manage domestic inflation. However, it is thought the limit is unlikely to be reached.

UK focus

Advertisement

Advertisement

UK feed wheat (May-22) reached a record high last Thursday, closing at £340.25/t. However, Friday saw some profit taking and the contract closed the week at £335.00/t. This is up £5.50/t on the week. The new-crop contract (Nov-22) gained £19.60/t last week, to close on Friday at £318.75/t.

UK delivered prices remain supported by tight global supply. On Thursday, East Anglia feed wheat (July delivery) was quoted £336.00/t. New-crop feed wheat prices for the same destination (Harvest delivery) were quoted at £311.00/t.

Bread wheat prices into North West (November delivery) were quoted on Thursday at £380.50/t.

As at the end-February, 3.85Mt of wheat was stored on farm in England and Wales according to the latest Defra stocks survey (up 45% on the year). Total wheat stocks held by merchants, ports, and co-ops at the end of February was at 1.28Mt (down 12% on the year), according to latest AHDB data. On farm barley stocks were at 767Kt (down 35% on the year), with the amount being held by merchant, ports, and co-ops at 786Kt (down 18% on the year).

Advertisement

Advertisement

The latest cereal usage data for GB animal feed and UK human and industrial sectors is now available.

Oilseeds

Rapeseed - Old crop supply remains tight. Increased EU sunflower area may ease some rapeseed demand for new crop, as EU weather remains in focus as harvest approaches.

Soyabeans - Concerns remain over global supply for old crop. Planting window weather for US soyabeans remains a key watch point.

Global markets - Soyabean prices softened over the week, on fund selling activity. Chicago May-22 futures were back $19.38/t Fri-Fri, closing at $608.23/t. Nov-22 futures followed suit over the same period, back $16.17/t to close Friday at $540.35/t. Lending further pressure, forecasts of a dry, warm period in the US will allow farmers to aggressively ramp up their planting campaigns, in addition to currency pressures negatively impacting on US exports.

Advertisement

Advertisement

Some support was felt at the end of the week, as diminished Brazilian exports led to further concerns over global supplies. In April, Brazil exported 11.58Mt of soyabeans, down 28% on the same period last year.

While down overall January to April on the year, China’s soyabean imports are expected up in April. These have been helped by cargoes finally arriving, after weather delays to Brazilian harvest (China’s main soyabean import origin). Also, Chinese pig margins now improving, which may support crush margins. These have been suppressed recently, dampening crush demand.

Palm oil prices recovered slightly at end of last week, after falling on expectations the Indonesian export ban could be lifted. However, it is currently unclear how long the ban will last. Indonesia’s April palm oil stocks are expected to show a rise for the first time in six months, to 1.55Mt, according to the latest Refinitiv survey.

Rapeseed focus

Paris new crop (Nov-22) rapeseed futures closed the week at €828.25/t, down €14.50/t Friday to Friday. Prices had fallen sharply on Monday, following news of an improved outlook for the EU crop and an increase in the EU sunflower area, but then climbed during the week before taking a breath on Friday.

Advertisement

Advertisement

The release of a below expected Canadian canola (rapeseed) stocks level, and dry, hot weather forecast for the EU, lent support during the week to the oilseed. Statistics Canada pegged the Canadian stocks figures, as at 31 Mar, at 3.9Mt, down 49% from Mar 2021 levels and 64% from Mar 2020 volumes.

Delivered rapeseed (Erith, Nov-22) was quoted at £719.00/t on Friday, down £29.00/t from the previous Friday.