Northern Ireland weekly market report

and live on Freeview channel 276

6 November 2023

Grains

Wheat

Short term, prices remain reactive to news on Southern Hemisphere grain supply, as well as global export competition. Going forward, plentiful maize boosting feed grain supplies are still expected to bring a bearish tone to markets.

Maize

Focus is on South American weather, supporting the outlook short term. Longer term, large supplies are still expected to weigh on feed grain prices. Watch out for the latest USDA estimates this Thursday (09 Nov).

Barley

Advertisement

Advertisement

Barley continues to follow wider movements in the grains complex. Longer term, like the wheat market, large maize supplies are expected to weigh on feed grain markets overall.

Global markets

Global grain movements were mixed last week as the market assessed Southern Hemisphere grain supply, as well as global export potential. Generally, prices felt pressure at the start of last week going into mid-week but regained a little strength towards the end of the week, with Chicago wheat and maize markets buoyed by a weakened US dollar on Friday. Overall, Chicago wheat markets ended the week lower, whereas Paris milling wheat gained apart from the May-24 contract. Chicago maize markets were mixed, with short term (May-24) prices easing, but longer-term prices gaining 1.1% on the week (Dec-24).

Last week, the Buenos Aires Grain Exchange (BAGE) cut their forecast for this season’s Argentinian wheat crop from 16.2 Mt to 15.4 Mt. Though this remains above last year’s drought impacted crop forecast at 12.2 Mt. For Argentinian maize plantings, BAGE peg plantings at 23.4%, behind the 5-year average by 8.8 percentage points.

Dryness in Brazil also remains in focus for maize supply, with Brazil’s second (largest) maize crop going in the ground from Feb 2024. Heavy rain has landed in southern Brazil, and some rain is due in the upcoming week across some areas of northern Brazil. Though this rain looks to remain below average for many areas, something to watch for global grain availability.

Advertisement

Advertisement

The market will be awaiting the latest World Agricultural Supply and Demand Estimates (WASDE) due Thursday (09 Nov), to see where the USDA peg US maize production, and Southern Hemisphere wheat and maize crops.

Looking to EU wheat specifically, prices felt some support last week on hopes for more exports to Morocco despite Black Sea wheat dominating competition recently. Morocco is already the EU’s top wheat importer this season. Also supporting prices has been the ongoing rain and stormy weather seen across France especially, as well as the UK. In the latest data from FranceAgriMer, French farmers had completed 62% of soft wheat plantings to 30 October, dropping back behind the five-year average of 72%.

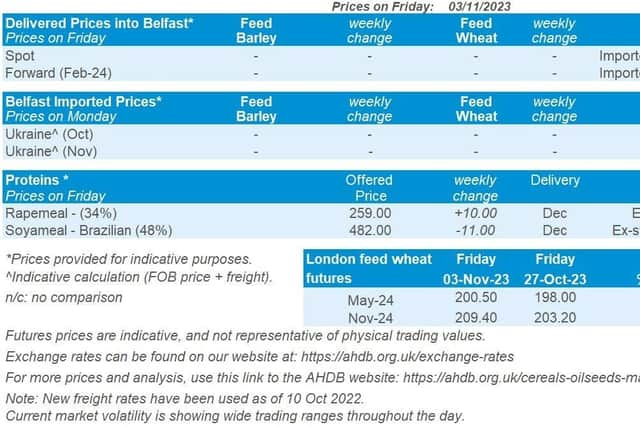

UK focus

May-24 UK feed wheat futures closed at £200.50/t on Friday, gaining £2.50/t on the week. The Nov-24 contract gained £6.20/t over the same period, ending Friday’s session at £209.40/t. UK feed wheat futures (Nov-24) gained as wet weather in the UK raised planting concerns for the harvest 2024 crop.

Delivered prices gained with UK feed wheat futures movements last week (Thursday to Thursday). Feed wheat delivered into East Anglia for February delivery was quoted at £192.00/t on Thursday, up £2.00/t from the week before.

Advertisement

Advertisement

Price movements for bread wheat were varied across the UK. Bread wheat delivered into the North West for November was quoted at £269.00/t, down £2.00/t on the week. While bread wheat delivered into London/Essex for November gained £0.50/t over the same period, quoted at £257.50/t on Thursday.

The UK has been feeling the impacts by varying degree following recent storms, with heavy rainfall causing significant disruption for many to winter planting. In October, the UK had 40% more rain than average, at 171.5mm. Counties including the east of Scotland Angus, Dundee, Fife and Kincardineshire, Armagh and Down in Northern Ireland, as well as Staffordshire, Nottinghamshire and the Isle of Wight all provisionally had their respective wettest October on record (Met Office). More rain is due to arrive for many this week, a key watchpoint for winter drilling progress. The next information that could give some insight to plantings and planting intentions for harvest 2024 will be AHDB’s Early Bird Survey, due this month.

Oilseeds

Rapeseed

Rapeseed prices follow the general sentiment of soyabeans. Longer-term if the large Brazilian soyabean crop comes to market, there will be further pressure on the oilseed complex.

Soyabeans

In the short-term, prices are very reactive to Brazilian weather with plantings on-going, as there is caution to whether Brazil will produce 160 Mt+ of soyabeans in 2024. If weather concerns ease, markets could see pressure.

Global markets

Advertisement

Advertisement

Another week of support for Chicago soyabean futures (May-24) as the contract gained 2.4% across the week to close Friday at $506.64/t. A mix of supportive news over the past week, such as Brazilian weather and a weaker US dollar on Friday. Also growing demand for US origin soyabeans kept markets bullish as the US soyabean harvest ends.

Continuing to dominate short-term sentiment is the mixed weather in Brazil, with excessive dryness in the North and excessive rains in the South. This is contributing to soyabean planting delays, with the latest data estimating soyabean plantings at 50.7% as reported on Friday, down from the same point last year when plantings were at 64.6% complete (Patria Agronegocios). At the start of this week, rains are expected in regions such as Mato Grosso, which should ease concerns to some extent. Markets are a little supported from these delays, as it brings into question Brazil producing a record soyabean crop. However, StoneX last week raised their Brazilian production forecast to 165 Mt, up from 164.1 Mt, putting confidence in Brazil continuing to produce this large crop. In Argentina, things are looking more optimistic as rains last week provided relief to soyabean crops and improved soil moisture (Rosario Grain Exchange).

It’s reported that China’s soyabean imports are likely to stay high throughout the fourth quarter of 2023, taking purchases to a record high (Refinitiv). China’s imports Jan to Sep 2023 jumped 14.4% year-on-year, dominated by Brazilian origin. It’s estimated that imports in the past three months of this year could bring total imports to 105 Mt for 2023, up from 91.1 Mt in 2022. Sustained and rapid development of China’s feed industry is keeping imports high, but there are anticipations of a drop in early 2024 as hog margins become squeezed.

US soyabean export sales (20-26 Oct) were reported at 1.01 Mt for 2023/24. This is down 27% from the previous week and 13% from the prior 4-week average, but this remained within market expectations. There was increases primarily for China who accounted for 976.8 Kt.

Rapeseed focus

Advertisement

Advertisement

Support in Chicago soyabean markets filtered into rapeseed last week. Also, there was some support for rapeseed from gains in Malaysian palm oil futures at the end of last week, as Indonesia confirmed the extension of their domestic market obligation policy until 2024. This policy ensures that producers can only export once they have sold a proportion of their products in the domestic market.

Paris rapeseed futures (May-24) gained €3.00/t over last week, closing at €451.00/t on Friday. The Nov-24 contract closed at €456.00/t on Friday, also gaining by €3.00/t over the same period.

Despite increases in Paris rapeseed futures, domestic rapeseed delivered into Erith for November was quoted on Friday at £359.50/t, falling £2.00/t across the week. Reasons for this were due to the AHDB delivered survey being undertaken mid-morning on Friday, not capturing the gains on the Paris market late Friday afternoon. Further to that, sterling strengthened (+0.6%) against the euro across the week to close Friday at £1 = € 1.1533.