The NI weekly market report

Grains

Wheat - The balance of global supply and demand remains tight. The market is concerned about the US crop, but the Russian crop looks big for 2022. In the UK, stocks in store will be something to watch as we head towards the season end.

Maize - Global supply remains tight currently. US maize plantings are delayed, and Brazil looks dry for their Safrinha crop. Demand remains something to watch with prices at a high level.

Advertisement

Advertisement

Barley - The barley market, globally and domestic, remains tight. Supported too by firm wheat and maize prices.

Global markets - Volatility remains in global grain markets, as we head towards the new season. This is as the market reacts to new news altering the tight balance between global supply and demand. Though this tight supply and demand balance is supporting prices which are at historic highs.

Rain in the US is causing delay to maize and spring wheat planting. As at 1 May, 14% of maize area was planted. This is behind last year by 28 percentage points (pp) and behind the 5-year average (2017 to 2021) by 19pp. Spring wheat plantings were at 19%, as at 1 May. This is 27pp behind last year and 9pp behind the 5-year average. Winter wheat crop conditions remained unchanged at 27% ‘good’ to ‘excellent’. This news is supporting grain prices today, as the short-term outlook shows rain to continue this week. Though drier weather is expected going further into May (Refinitiv).

India too remains a focus for the market. High temperatures in mid-March have reportedly trimmed wheat yield potential, according to an Indian government note. Wheat output could be reportedly 6% below initial estimates, which may limit export capacity.

Advertisement

Advertisement

Though Russian soil moisture is reportedly good and will benefit their record 2022 wheat crop. SovEcon forecast this crop to be 87.4Mt, with 2022/23 wheat exports pegged at 41.0Mt. Currently, Russia is working their way around sanctions and picking up a significant amount of global demand.

Points to watch on demand. US wheat export sales came in below trade expectations for old and new crop, for the week ending 21 April. This pressured Chicago wheat prices last Thursday. Maize too had disappointing export sales. Also, the US Environmental Protection Agency (EPA) has sent US biofuel mandate rule to the White House for review. This will detail biofuel blending requirements retrospectively.

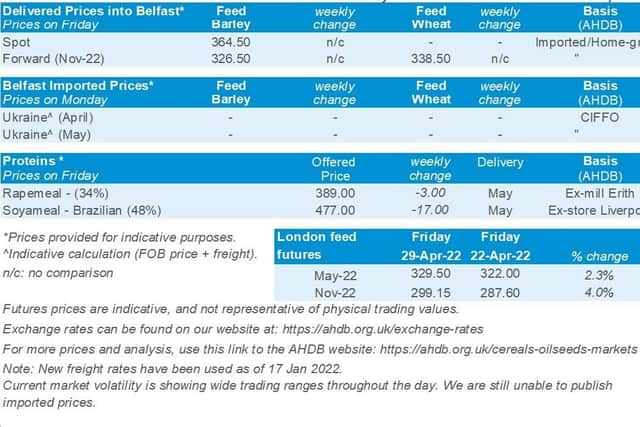

UK focus - UK feed wheat futures (May-22) gained £7.50/t last week, to close on Friday at £329.50/t. New-crop futures (Nov-22) gained £11.55/t to close on Friday at £299.15/t. UK prices follow global movements closely. But on Friday we saw some profit taking ahead of the long weekend.

Delivered prices followed global movement Thurs to Thurs. Though a lack of selling and price volatility make publishing accurate prices more challenging.

Advertisement

Advertisement

Feed wheat prices (Nov-22, delivery to Avonmouth) gained £20.00/t to be quoted on Thursday at £306.00/t. We also published a feed barley price (May-22, delivery to Yorkshire) at £326.00/t.

New-crop bread wheat (Nov-22, delivery to Northamptonshire) was quoted on Thursday at £347.00/t.

The latest crop condition report for UK crops as at 27 April 2022, is now available on the AHDB website.

Oilseeds

Rapeseed - Inelastic demand for rapeseed and rape oil will keep the nearby market supported, as globally we are in short supply. Longer-term support for rapeseed is also forecasted, due to the conflict in Ukraine limiting sunflower supply.

Advertisement

Advertisement

Soyabeans - Old crop US ending stocks are going to marginally recover for 2021/22 but remain tight. The smaller than anticipated South American crop supported the market. Chinese demand is a watchpoint from recent Coronavirus lockdowns. Longer-term we are looking to US 2022/23 crop prospects.

Global markets - The Chicago soyabean futures (May-22) saw pressure overall across the week last week, as the contract closed Friday at $627.61/t.

Despite this, there was an element of support throughout the week from crude oil markets and soyoil. Chicago soyoil (May-22) hit record highs on Thursday (28th Apr) to close at $1997.37/t.

The main bullish story last week was Indonesia (the largest global producer of palm oil) stating that their palm oil export ban would also cover crude palm oil. This put a bullish spur into vegetable oil markets and Malaysian palm oil futures (Jul-22) gained 11.79% across the week, closing at a record high on Friday. Shortages are reported to be resolved in the coming weeks and a lift on the export ban should come in May. However, if it doesn’t this will add to the longer-term bullish sentiment.

Advertisement

Advertisement

Starting this week, further pressure came yesterday as Chicago soyabeans (May-22) closed down by 2.0% across the day. Latest lockdown measures in major cities in China are perceived to weaken US export opportunities.

Furthermore, the latest USDA crop progress report that maize cropping is slow, which could lead to more soyabeans being planted. This is as the soyabeans planting window sequentially falls after maize.

Rapeseed focus - Paris rapeseed new crop futures (Nov-22) closed at €842.75/t, down €8.75/t across the week.

Yesterday new crop futures (Nov-22) closed down €40.50/t across the day to close at €802.25/t. New crop futures were pressured due to an improved outlook for EU-27 oilseed production. Stratégie grains oilseed report sharply increased EU-27 sunflower seed harvest to be at 10.7Mt, up from 10.2Mt reported the month before. Reasons for this increase were due to the EU giving authorisation to use fallow land to compensate for potential shortages from Black Sea.

Advertisement

Advertisement

Delivered rapeseed (Into Erith, Hvst-22) was quoted at £743.00/t on Friday, with no comparison on the week. While the November-22 delivery, to same destination, was quoted at £748.00/t.

Futures prices are indicative, and not representative of physical trading values.