The NI weekly market report

and live on Freeview channel 276

Grains

Wheat - Tight global supply and demand supports further price gains, for old and new crop. Dry conditions in parts of the world squeeze the supply outlook for harvest 22, though the Russian crop looks large.

Maize - Supply remains tight for global maize. Though the question remains, can demand be sustained at historical highs? US harvest 22 planting progress is eagerly awaited by the market.

Advertisement

Advertisement

Barley - The barley market remains tight, globally, and domestically. Prices are supported further by firm wheat and maize prices.

Global markets - Global grain markets continue to find support from a tight supply and demand picture, for this season (2021/22) and next season (2022/23).

The latest USDA World Agricultural Supply and Demand Estimates (WASDE) were released on Thursday, the first report to detail the 2022/23 outlook. Global wheat supply and demand next season looks tight. Lower year-on-year forecasted production in Australia (-6.3Mt), Ukraine (-11.5Mt) and Morocco (-5.3Mt) outweighed increased crop outlooks for Russia (+4.8Mt), Canada (+11.3Mt), and the US (+2.3Mt) (considering dry conditions last season).

Forecasted maize supply and demand for 2022/23 also looks tight, with the outlook for reduced ending stocks. This is because of reduced crop forecasts for Ukraine (-22.6Mt), the US (-16.6Mt), the EU (-2.2Mt), and China (-1.6Mt). These declines outweigh increased forecasted production in Brazil (+10.0Mt), Argentina (+2.0Mt), South Africa (+1.0Mt) particularly.

Advertisement

Advertisement

In addition to conflict between Russia and Ukraine, dry weather notably in India and France is contributing to a tight supply picture for harvest 22.

In India, hot weather in March resulted in a trim to their crop forecast. A key factor driving prices in recent weeks. At the weekend, India banned wheat exports to dampen domestic prices. Though the government have assured that exports will continue to countries who need supplies to meet food security needs (importantly including Egypt), and if backed by already issued letters of credit. With exports previously pegged at reaching 10.0Mt this season, the market looked to India to fulfil some global demand for the season remainder, and we have seen a reaction to prices.

Some rain arrived in large parts of France overnight, according to a French agriculture association FNSEA. Though this is likely not enough considering French cereals have seen prolonged drought periods. Something to watch going forward.

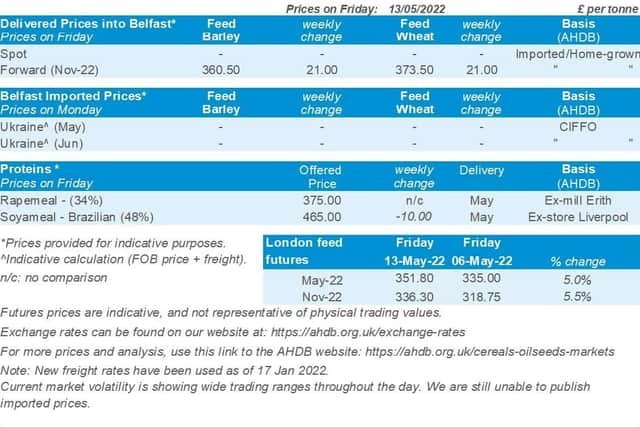

UK focus - UK feed wheat futures continue to follow global movements. The May-22 contract gained £16.80/t last week, to close on Friday at £351.80/t. The new crop contract (Nov-22) gained £17.55/t last week, to close at £336.30/t. We can see new-crop prices are moving up towards old-crop levels. Earlier this week, the Nov-22 contract was trading at £349.00/t (12:00BST) on the Indian export news.

Advertisement

Advertisement

UK delivered prices continue to follow futures market movements. On Thursday, feed wheat into East Anglia (Jul delivery) gained £7.50/t (Thurs to Thurs) to be quoted at £343.50/t. To this same destination, Nov-22 gained £22.00/t (Thurs to Thurs) to be quoted at £337.50/t.

Bread wheat prices delivered into Northamptonshire (Nov-22) gained £19.00/t last week, to be quoted at £383.00/t.

Oilseeds

Rapeseed - Short-term, the rapeseed market will remain inflated until the Northern Hemisphere new-crop comes online this summer. Outlook longer-term looks better supplied, a recovery in Canadian production is key for the global market, after last year’s drought.

Soyabeans - Short-term, the market is supported by global market news including the Ukraine/Russian war. Longer-term supplies are going to increase, but so is global demand. US weather is a watchpoint for planting on-going currently.

Advertisement

Advertisement

Global markets - Chicago soyabean futures (Nov-22) closed Friday at $550.46/t, gaining 1.9% ($27.50/t) across the week.

Supporting soyabeans last Friday was the optimism for increased demand for US origin soyabeans from China, as they begin to ease tough COVID-19 restrictions. It was reported on Friday that a sale of 132.0Kt of soyabeans was made to China for the 2021/22 marketing year. Chinese pig margins are reportedly improving too, boosting the outlook for new season buying.

USDA new-crop outlook was released last week. Global oilseed production is forecasted up 50.3Mt year-on-year. Global soyabean production for 2022/23 is forecasted up 45.3Mt to 394.7Mt, with record crops forecasted in Brazil and the US. However, this higher production is met with higher global consumption due to increase demand for biofuels and crushing.

Exports of Malaysian palm oil products from 1 – 15 May rose 20.6% to 569.2Kt from 472.2Kt shipped during the same period in April (Cargo Surveyor - Intertek Testing Services).

Advertisement

Advertisement

Despite increased exports, Malaysian Palm oil futures (Aug-22) logged a second week of losses. Bearish elements still linger for the oil as global markets expect Indonesia to revise their export ban.

Rapeseed focus - Paris rapeseed futures (Nov-22) closed Friday at €857.50/t, gaining €29.25/t across the week.

Delivered rapeseed (into Erith, Nov-22) was quoted Friday at £731.00/t, gaining £12.00/t across the week.

Gains on our domestic market were limited across the week due to sterling strengthening against the euro to close Friday at £1 = €1.1773.