The NI Weekly Market Report

and live on Freeview channel 276

9 January 2024

Wheat

Short-term ample competitive Black Sea grain dampens prices, however ongoing wars keep trade flow in focus. For the longer-term, as spring approaches and harvest 2024, planting and conditions will be more closely followed, especially on the continent.

Maize

For the short term, while rains in Brazil have supported the first maize crops sown late, the challenging weather conditions continue to weigh on the yield outlook. For the longer-term, the favourable growing conditions in Argentina could potentially offset some loss of maize production in Brazil.

Barley

Advertisement

Advertisement

Although barley prices continue to follow the wider grains complex, as planting intensions and weather conditions for spring become in greater focus, this will look to influence the market outlook.

Global markets

While a technical bounce helped to support grain prices during the week, overall, global grain markets were pressured last week. Black Sea grain remains both ample and competitively priced. However, adverse weather in Europe remains watchpoint for 2024 harvests. In South America, despite a mixed maize crop in Brazil, Argentina’s maize crop is performing above average.Black Sea grain prices at present remain competitive, and with Russia bearing ample supplies, this will continue to weigh heavily on western European prices. Furthermore, after some recent challenging weather conditions in Russia hindered loading pace, Russian wheat exports have subsequently returned to a more average rate (US Wheat Associates).Following an attack on a container ship travelling through the Red Sea, linked to the war in the Middle East, freight costs and logistics have come into focus. As well as impacts to cost, some Ukrainian export companies have said they will postpone container sales, as the higher container freight costs makes Ukraine grain sales more complicated (LSEG).Focus remains on weather across the continent, after substantial rains and consequential flooding across France and Germany in recent weeks. In addition, a forecast drop in temperatures across the Baltic countries has created some concern, as a lack of snow cover exposes the crop to frost damage.There is a mixed picture for the development of the first maize crop in Brazil, as some regions have experienced irregular rainfall and high temperatures, in focus for the yield outlook, while later sown maize benefits from improved germination. As at 30 December, 80.4% of Brazil’s first maize crop has been planted, 6.9 percentage points (pp) below last year’s progress at this time. While in Argentina, maize planting has increased to 77.6% complete, up 7.6 pp from the same time last year. The crop condition remains above the 5-year average, with 97.5% of the maize crop in a normal/excellent condition.

UK focus

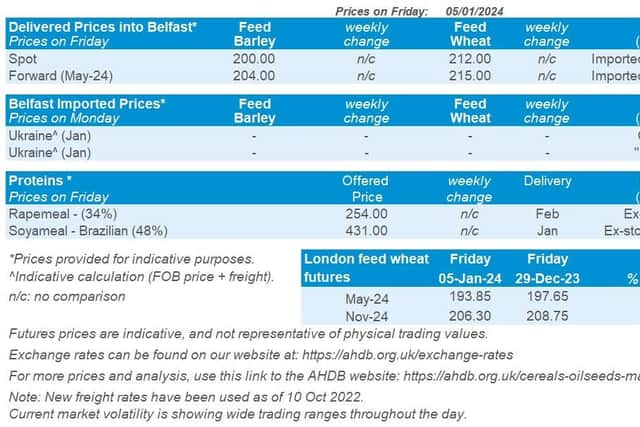

Domestic wheat futures followed global market movements down last week (Friday to Friday). UK feed wheat futures (May-24) closed at £193.85/t on Friday, down £3.80/t on the week. New crop futures (Nov-24) ended Friday’s session at £206.30/t, down £2.45/t over the same period.Feed wheat delivered into East Anglia for February delivery was quoted at £189.00/t on Thursday.In the North West, delivered bread wheat for February delivery was quoted at £272.50/t on Thursday. While milling premiums are not at the highs seen at the beginning of the season, they remain historically elevated. For May delivery, as at 04 January, North West bread wheat was quoted at £276.50/t, a premium of £81.50/t above the May-24 UK feed wheat futures contract close.

Oilseeds

Rapeseed

Downward price potential on rapeseed is more limited longer-term if supplies from EU are lower for harvest-24. However, the general market sentiment will largely be dictated by soyabeans.

Soyabeans

Advertisement

Advertisement

Soyabean prices have been pressured from on-going rains in Brazil, which are forecast to continue. This rain is confirming that South American supplies are longer-term going to pressure the market with large supplies.

Global markets

A week of pressure for Chicago soyabean futures (May-24) as the contract closed Friday at $464.49/t, down 3.3% across the week. Dominating the pressure on the market this week was Brazilian weather, a stronger US dollar and lacklustre demand for US soyabeans.To start, significant rains across northern parts of Brazil has really eased yields concerns over the past week which has largely contributed to market pressure. Despite some Ag consultancies revising the Brazilian soyabean crop down to nearer to 150 Mt than 160 Mt. These recent rains have confirmed that there isn’t going to be any huge supply constraints from South America for the second half of this marketing year, which will ease demand further for US origin. Further to that, year on year increases to Argentina (+23 Mt), Paraguay (+950 Kt) and Uruguay (+2.2 Mt) soyabean crops are likely to fill the gap from the marginal shortfall from Brazil.The USDA reported US soyabean export sales (to week ending 28 Dec) for 2023/24 at 201.6 Kt, below trade expectations of 500 Kt to 1.3 Mt.Malaysian palm oil futures were pressured at the start of the week but then started to recover, as Malaysia’s end-December stocks are expected to decline on an output drop, despite shrinking exports. In a Reuters survey palm oil stocks are estimated at 2.37 Mt at the end of December, down 2.3% from November. The Malaysian Palm Oil Council is expected to release official data on Wednesday (10 Jan) (LSEG).In other news key data release this Friday (12 Jan) from the USDA is the US quarterly grains stocks and the January World Agricultural Supply and Demand Estimate, where there is anticipated downward revisions to the Brazil soyabean crop.

Rapeseed focus

Rapeseed markets were pressured with the downward movement in soyabeans. Paris rapeseed futures (May-24) closed Friday at €424.25/t, down €16.50/t across the week. Pressure was more limited for new crop futures (Nov-24) which closed at €430.75/t, down €13.25/t over the same period.There was pressure on ICE canola futures from technical selling, weaker soyabean prices and lacklustre Canadian exports.Delivered rapeseed prices (into Erith, Jan-24) were quoted at £364.50/t on Friday, with no comparison on the week.

Harvest-24 prices were quoted at £368.00/t for the same location.