MI Northern Ireland Market Report

Global grain markets saw a mixed week of trading last week (Friday 2 - Friday 9 March) centred upon news from the United States.

Market movement has been driven in part by the USDA World Agricultural Supply and Demand Estimate (WASDE), USDA crop reports and reported profit taking in the Chicago wheat futures market. Additionally, markets have reacted to fears over possible agricultural impacts from the Trump administration’s steel and aluminium tariff announcement.

Advertisement

Advertisement

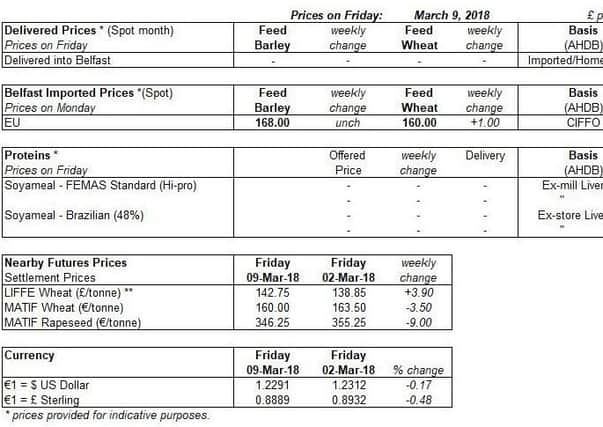

Prices for imported feed grains have risen sharply in early 2018 in Northern Ireland, in particular for feed barley. The cost of imported feed barley is now the highest in four years and above that for feed wheat for the first time since mid-2015 (read more here)

The March USDA WASDE projected 2017/18 US maize exports to reach 56.52Mt, up 4.45Mt from the February projection. Higher export levels are lowering projected ending stocks, leading to a bullish view on US maize. The market view toward maize was typified by the trading positions held by funds on Chicago maize futures, collectively taking the most bullish position since June 2016.

Ukrainian grain crops are reported to be in the “best condition in four years” (UkrAgroConsult), due to a benign winter. The 2018/19 wheat crop is forecast at 26.3Mt, slightly higher (1%) year on year. Exports are forecast to increase by 0.5Mt over the same period to 17Mt. Ukrainian barley output is forecast at 8.7Mt next season, up 5% on the year, with exports expected to increase by 0.5Mt to 5Mt.

Global oilseed prices fell last week, despite sharp cuts to expectations of Argentine soyabean production due to the continuing drought. The main factor for the price falls is the potential for a trade war between the US and some of its key trading partners. UK rapeseed prices followed the global trend and declined sharply Friday-Friday.

Advertisement

Advertisement

Argentina soyabean output was cut sharply (-7Mt) to 47Mt in the latest WASDE, as a result of continuing drought in the country. This reduction now means global output is pegged some 3Mt below forecast demand this season (2017/18) by the USDA. If confirmed, this would result in a drawdown in global soyabean stocks, when a further increase was previously expected. However, the Buenos Aires Grain Exchange forecast the Argentine soyabean crop even smaller (at 42Mt) on Thursday, 15.5Mt below last season’s crop (57.5Mt).

The Brazilian soyabean crop is now forecast at 113Mt by Conab (Brazilian government supply agency), up 1.5Mt from last month and less than 1Mt below last season’s record. The USDA also increased its forecast by 1Mt on Thursday to 113Mt. Higher output from Brazil may soften some of the impact from lower Argentine production.