MI Northern Ireland Market Report

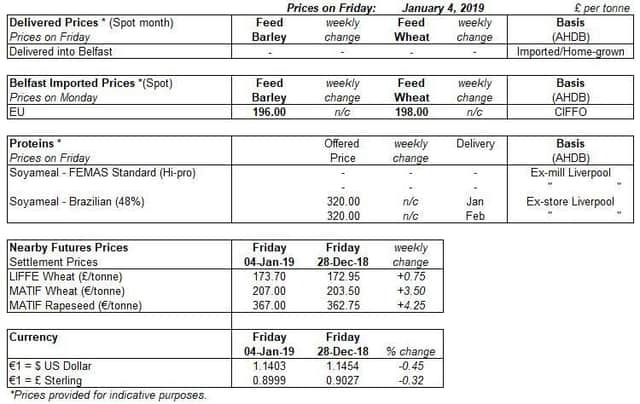

Grain markets were firmer across the board as trade got underway in 2019.

Improved US export prospects led the way for prices, with Chicago wheat futures (May-19) gaining $3.58/t (Wed-Fri). UK wheat futures (May-19) were closer to flat, with limited volume traded, gaining just £0.40/t from 02 January to 04 January.

Advertisement

Advertisement

Conflicting weather in South America has raised questions over the condition of wheat and maize in Argentina and Brazil. Wet weather in Argentina is increasing concerns around quality and yield losses in the wheat and maize crops. Conversely a continuation to the dryness in Brazil is threatening the development of maize crops. The current weather patterns in South America are forecast to continue for the next two weeks.

Additionally, US export hopes were reportedly boosted last week. Although data surrounding volumes exported is delayed by the federal shutdown, anecdotal reports suggest that increased concerns over Argentinian quality, combined with US cash prices discounting to Russian has boosted global wheat prices.

Meanwhile oilseed futures rose last week (Friday 28 Dec – Friday 04 Jan). Chicago soyabean futures (May-19) were buoyed by optimism surrounding ongoing trade talks between China and the US, along with adverse South American weather. Paris rapeseed futures (May-19) also rose over the week, likely in part due to support feeding through from the soyabean market.

Trade talks between China and the US began this week, as a US delegation visited Beijing to meet with Chinese counterparts. The talks follow a break in the dispute in December, during which China agreed to suspend the tariffs in place on US soyabeans. While progress is unknown at this stage, the willingness of both parties to come to the table is seen as a positive step in resolving the ongoing dispute.

Advertisement

Advertisement

Ongoing dry weather in key Brazilian soyabean growing areas is reportedly causing yield losses. As a result, consultancy INTL FCStone slashed their forecast for Brazilian soyabean production by 4Mt, to 116.25Mt last week, according to a report by Reuters. The consultancy’s estimate is 5.75Mt lower than the current USDA estimate.