MI Northern Ireland Market Report

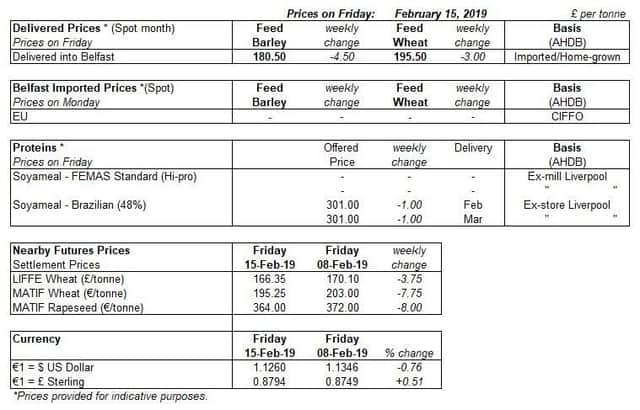

UK wheat markets closed significantly lower on the week (8 February - 15 February). At Tuesday’s close (19 February) May-19 futures stood at £166.80/t, Nov-19 futures were worth £149.25/t.

The potential imposition of fresh US sanctions on Russia devalued the rouble significantly, this dropped the price of wheat amongst other global exporters in an attempt to remain competitive. UK markets followed suit tracking the value of Paris wheat lower. Appreciation in the value of sterling also helped to drop wheat prices.

Advertisement

Advertisement

The outlook for new crop wheat remains bearish. There is still a strong suggestion that the 2019/20 crop will be a big one globally, even with a cut to the US wheat area earlier this month.

The weather outlook in the Northern Hemisphere remains positive, with no major concerns in the US, EU or Black Sea. Where temperatures are tending slightly colder (US and Black Sea) there is little to no winter kill risk.

With little change in global fundamentals last week, the bearish sentiment saw oilseed markets close lower Friday-Friday. Chicago soyabean futures (May-19) fell marginally Friday-Friday, with price shifts during the week a result of the ongoing trade dispute between the US and China. Old crop Paris rapeseed futures (May-19) declined €8.00/t over the course of the week, as a lack of fresh information and limited demand pressured prices.