MI Northern Ireland Market Report

It was a variable week for grain markets, with prices falling in the first half of the week on the back of trade worries as global trade disputes continued to develop.

Selling activity by speculative traders was also reported to have contributed. However, crop concerns in Russia and parts of northern Europe, including Germany and Poland, boosted prices later in the week.

Advertisement

Advertisement

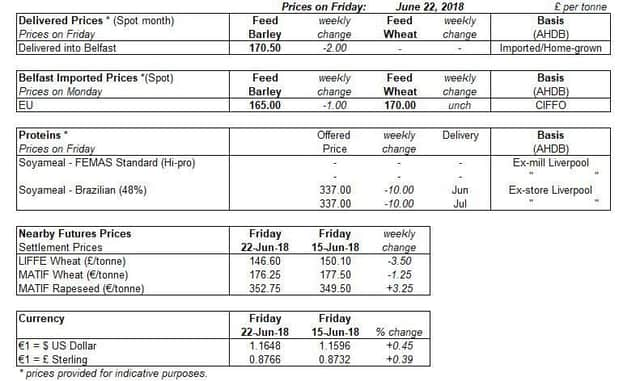

Overall, US and Paris wheat futures only recovered part of the earlier losses by the end of trading on Friday and ended the week lower. In contrast, UK feed wheat futures ended the week slightly higher, boosted by weaker sterling.

The EU has implemented retaliatory tariffs on some US products, including maize. This is part of a series of ongoing trade disputes involving the US. The uncertainty caused by these disputes in terms of future global trade continues to hang over markets, though this has been largely held at bay by crop concerns so far. However, markets will soon start to get a clearer picture of harvest and unless yields are worse than expected, this could again become a key factor for price direction.

On the back of insufficient rainfall in Ukraine, UkrAgroConsult has lowered its production forecasts for wheat and barley in 2018/19. Wheat production is forecast to be at 25.5Mt, down from 26.3Mt in May and the lowest since 2014/15. As a result, the consultancy also reduced its forecast of the country’s export potential to 16Mt, down 6% year on year.

The ongoing US-China trade dispute continued to loom over markets causing uncertainty. In the US, nearby futures closed at a two year low following additional tariff threats on Chinese goods. Meanwhile in Europe, new crop rapeseed futures rose with markets reacting to projected EU yield reductions.

Advertisement

Advertisement

The announcement from President Trump of an additional $200 billion worth of tariffs on Chinese goods led soyabean futures (nearby) to slip to a two year low last Thursday (21 June). This followed confirmation from Beijing of proposals to place tariffs on US soyabeans from 6 July. The Mexican government have also threatened to impose import tariffs on US soyabeans, with Mexico being the second largest export destination country for the US crop.