MI Northern Ireland Market Report

Grains

(Week ending 5 July):

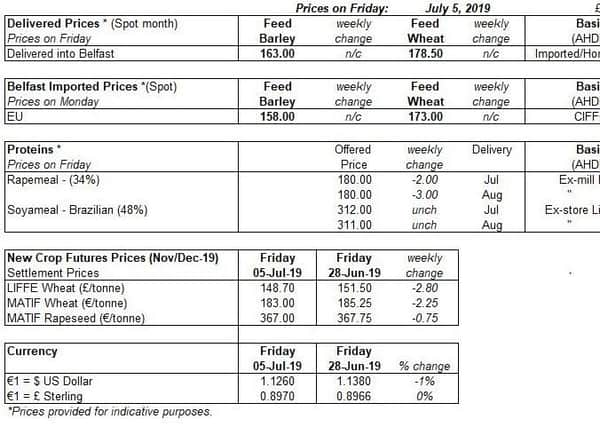

- Feed Barley, delivered to Belfast (spot) at £163.00/t

- Feed Barley, imported to Belfast (spot) at £158.00/t

- Feed Wheat, delivered to Belfast (spot) at £178.50/t

- Feed Wheat, imported to Belfast (spot) at £173.00/t

Wheat (Neutral - Bearish) Large global supplies and forecasts of good harvests are driving a marginally bearish feeling to the market at the moment. However, volatility from the maize market will drive daily movements.

Barley (Bearish) The UK barley area is forecast at 1.13Mha. The EU market looks well supplied and attention will be on the quality of western European and Scandinavian crops.

Global Markets

Advertisement

Advertisement

Wheat markets fell back last week with global wheat supplies still looking plentiful. The latest harvest report from the US Wheat Associates shows that while harvest remains behind average, quality is favourable. Furthermore, the Ukrainian wheat harvest is progressing well at 22% complete, with yields ahead of last year.

The wheat harvest has started in France, albeit in selected regions. The French wheat crop was not drastically affected by the recent heatwave. French wheat crop conditions still look positive, with 75% rated good or very good.

UK Focus

Last week’s AHDB Planting and Variety Survey estimates pegged the UK wheat area at 1.80Mha, up 4% on 2018 levels. If yields are average (8.3t/ha) UK wheat production could reach 15Mt. In that position the UK will be reliant on exports.

UK wheat exports are likely to be centred on southern Europe, with Spanish production feeling the pressure from the European heatwave. Competition into Southern Europe will likely come from Ukraine. Ukrainian feed wheat (FoB, August) is currently offered at £142.03/t. UK feed wheat (FoB, July) was offered at £156.00/t last week.

Oilseeds

(Week ending 5 July)

Advertisement

Advertisement

• Oilseed Rape, delivered to Erith (July-19) is down £0.50/t, at £322.50/t

• Rapemeal (34%), ex-mill Erith (July-19) is down £2.00/t, at £180.00/t

Rapeseed (Neutral) Global stocks remain large and the Ukrainian harvest is progressing well. The outlook for the EU remains tight. Harvest has now started and yields will be watch closely.

Large stocks of US soyabeans, improved weather conditions and African Swine Fever will continue to limit market gains for soyabeans and place a ceiling on EU rapeseed prices. As such, Managed Money funds have remained in an overall short position on Chicago soyabean futures, expecting prices to fall.

Advertisement

Advertisement

Paris rapeseed futures had a volatile week last week. New-crop futures (Nov-19) closed the week marginally down following US soyabean markets. With harvest underway in continental Europe, yields will be key to future market direction. In Ukraine, the forecast record harvest is now 30% complete with yields in line with last year.

The AHDB Planting and Variety Survey estimates the English oilseed rape area for harvest-19 at 483Kha, a 16-year low. In Scotland the area has reduced to a lesser extent, down 6% at 31Kha, suffering from less pest damage.