MI Northern Ireland Market Report

Grains

(Week ending 28 June):

Wheat

Neutral - Bearish - Global supplies for 2019/20 look favourable with increased Canadian area and conditions good in the US. The European heatwave remains an important watch point with crops in yield determining stages.

Global Markets

- Chicago grain futures continued to fall week-on-week (21 June to 28 June). Maize dropped $8.66/t, on the back of the USDA acreage report released on Friday. The corn area was reported at 37.1Mha, 2Mha above trade expectations in a Reuter’s pre-report poll. This is likely to drop further in a revised report on 12 August.

Advertisement

Advertisement

- Wheat markets remained stable last week, but European markets have followed maize lower today. With many wheat crops at grain filling, the European heatwave remains a watch point for yield and crop conditions.

- The wheat market continues to look well supplied. Drier weather in the US allowed wheat harvest to progress and quality remains good. Similarly, harvests in Russia and Ukraine are underway, easing some dryness concerns for winter crops. Elsewhere, Canadian wheat (excluding Durum) and corn areas are forecast up year-on-year (Statistics Canada, 26 June) with recent rainfall alleviating dryness concerns.

UK Focus

-UK physical price movements for old-crop varied last week, while new-crop prices generally improved. Milling wheat for July delivery into Northampton, continued to firm. Prices for old-crop feed wheat delivered to East Anglia and Yorkshire fell, with demand slowing as we near harvest. New-crop delivered feed wheat and barley prices generally firmed.

- Warm, dry weather experienced for most of last week and forecast for this week should assist with crop development. Dry weather should also allow for timely spray applications minimising disease concerns arising from previously wet and warm weather.

Oilseeds

(Week ending 28 June)

Advertisement

Advertisement

• Oilseed Rape, delivered to Erith (July-19) quoted at £323.00/t

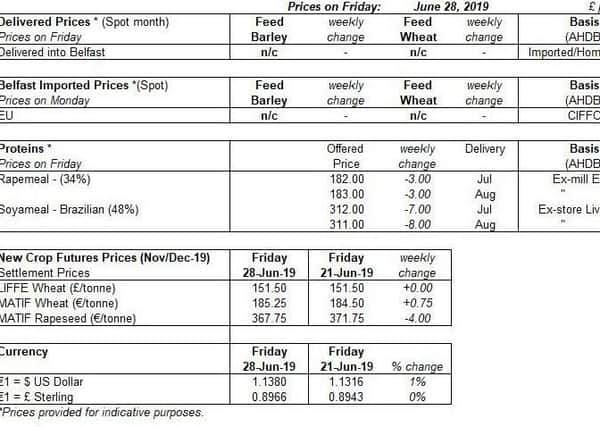

• Rapemeal (34%), ex-mill Erith (Jun-19) is down £3.00/t, at £182.00/t

Rapeseed

Neutral - Bearish - The global outlook for rapeseed has tightened slightly. EU supply and demand still looks tight, and Canada canola plantings are down year-on-year. That said, global rapeseed stocks remain large.

- New-crop physical rapeseed prices were marginally down last week, tracking Paris rapeseed futures lower.

Advertisement

Advertisement

-EU rapeseed production is forecast to reach less than 18Mt this season according to Stratégie Grains, following poor establishment conditions and continued pest challenges. Furthermore, Canadian canola plantings were less than intended at a three year low of 8.5Mha, down 2% on the previous estimate (April) (Oilworld.biz).

- The reduced area of canola in Canada, is likely a reaction to the ongoing trade dispute with China.

The dispute has resulted in increased stocks, which combined with forecast production increases for Ukraine and Australia have pressured prices.