MI Northern Ireland Market Report

Grains (Week ending 17 May):

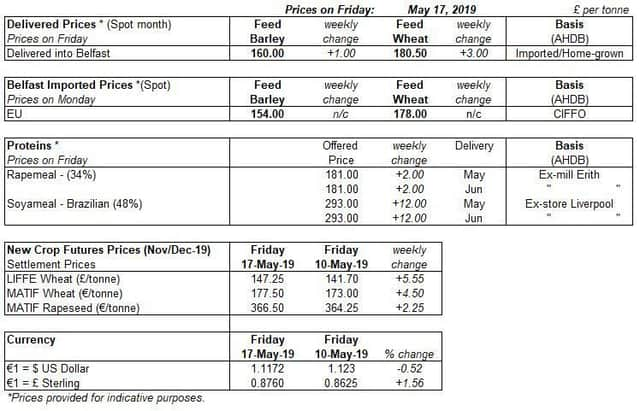

Feed Barley, delivered to Belfast (spot) up £1.00/t, at £160.00/t

Feed Wheat, delivered to Belfast (spot) up £3.00/t, at £180.50

Feed Barley, imported to Belfast is quoted at £154.00/t

Feed Wheat, imported to Belfast is quoted at £178.00/t

Advertisement

Advertisement

Bullish - Global grain markets somewhat reversed last week with a more bullish tone. Chicago, Paris and UK new crop wheat futures recovered from contract lows as rain in the US continues to delay maize planting.

New-Crop Wheat Temporary Bullish

New Crop wheat futures have gained support from delays to US maize planting and are higher again today with increased rainfall forecast across Kansas.

Additionally, a reduction in the Short position of Managed Money funds either profit taking or reducing exposure has supported US new crop wheat futures.

UK New Crop feed wheat futures, having fallen to a contract low of £141.00/t on 13 May, closed the week up £5.55/t at £147.25/t on Friday. Further support for new crop UK feed wheat also came from a weaker pound.

Advertisement

Advertisement

However, longer term, the outlook for wheat remains bearish. Conditions across Europe, the Black Sea and for US winter wheat remain favourable and Canada is forecast to harvest the largest crop in six years (Statistics Canada, USDA). Additionally, in the latest EU Commission MARS report, overall wheat, barley and maize yields are forecast above average

Globally, wheat production in 2019/20 is set to be the largest on record and Black Sea export competition is likely to increase.

UK Old Crop

Wheat prices have continued to fall. The discount into new crop prices has pressured old crop domestic wheat prices.

Feed wheat for May delivery into Belfast fell for five consecutive weeks with an upward turn week ending 17 May.

Advertisement

Advertisement

Quoted at £180.50/t for May delivery on the 17 May, delivered feed wheat into Belfast has lost £19.00/t since 18 January 2019.

Feed Barley delivered into Belfast has seen a similar trend with prices remaining firm week ending 17 May. However, the drop since 18 January has been more significant than wheat, losing £36.00/t.

As Old Crop and New Crop prices are now converging, this may now start to offer support to the old crop market and slow the rate of decline.

Oilseeds

(Week ending 17 May)

• Oilseed Rape, delivered to Erith (Jun-19) is £318.50/t

• Rapemeal (34%), ex-mill Erith (May-19) up £2.00/t, at £181.00/t

Advertisement

Advertisement

Temporary Bullish – Chicago soyabean futures for new crop (Nov-19) hit a contract low last Monday at $304.02/t. However, with US soyabean planting notably behind the five year average and a continued forecast of rainfall, markets have continued to move sharply higher.

Paris rapeseed futures followed the same trend hitting long-term lows on Monday (13 May), climbing throughout the week, closing yesterday at €368.75/t (21 May).

Bearish - Continued trade disputes between US and China, US’s leading soyabean buyer, are weighing heavily on the oilseeds markets.

Potentially Bullish - EU oilseed rape production forecasts are currently below the five year average, at 19.2Mt (EU Commission). Today’s MARS report has confirmed expectations, with no real shift in estimates

Advertisement

Advertisement

One to watch – Oilseeds are still in a weather market with planting concerns in the US weighing heavily on the market. Also weather is still causing concerns for South American harvest of soyabeans. EU rapeseed has been assisted by some well-needed rainfall, bringing optimism around potential oilseed rape production.