MI Northern Ireland Market Report

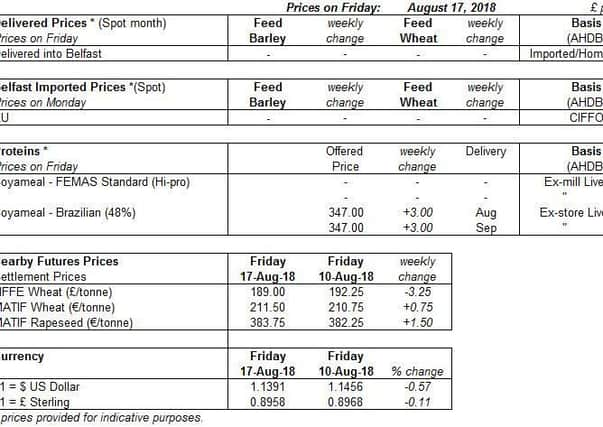

UK feed wheat futures had a volatile week (Friday-Friday), falling to a three week low on Wednesday 14 August before recovering some of the loss.

However, other major European and US markets overall had week on week gains. UK feed wheat futures (Nov-18) are now trading below Paris milling wheat futures (Dec-18) in sterling terms.

Advertisement

Advertisement

The US Pro Farmer crop tour, which started on Monday 20 August will be closely watched for potential maize yield insight. The latest USDA supply and demand report on 10 August raised US coarse grain production, up 9.6Mt from the previous report due to higher projected maize yields.

Around 35% of the GB spring barley area had been harvested, as at 14 August, slightly behind 2014 but ahead of other harvests in the last five years.

Reports suggest that quality is better than expected given the difficult conditions this year. However, yields have varied drastically with the average yield at this point estimated at 5.1-5.5t/ha, sitting below the five year average yield of 5.8t/ha.

The 2018 English wheat area according to the provisional results of Defra’s June survey of agriculture was reported at 1’642kha.

Advertisement

Advertisement

The Defra English wheat area is down just 1% from 2017, while AHDB’s survey showed a 2% decline.

Meanwhile, the 2018 English area of oilseed rape was 564Kha, 8% higher than in 2017. This shows good correlation to results from the AHDB Planting and Variety Survey, which were 9% higher than in 2017.

Global oilseeds markets rose last week, with news of fresh trade talks. US soyabean futures rose on Thursday 16 following news of both US and Chinese government officials planning to meet and discuss trade.

In Europe, markets reacted to this and forecast increased import demand for rapeseed by China.