MI Northern Ireland Market Report

Continuing unfavourable conditions across major wheat producing countries led to further downward revisions for wheat production forecasts, which gave further support to grain markets last week.

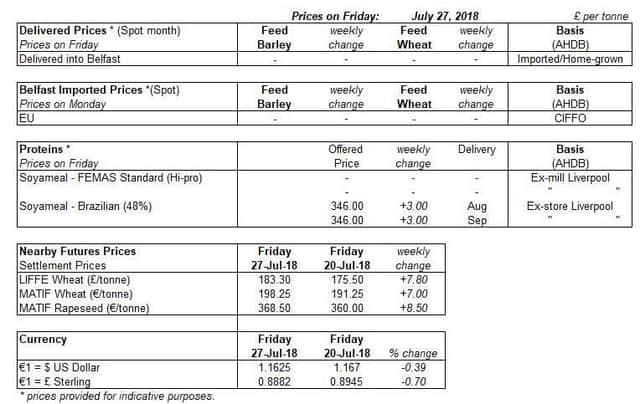

Both UK feed wheat futures (Nov-18) and Paris milling wheat futures (Dec-18) hit new contract highs on Wednesday 25 July. Meanwhile, concerns over the variability of US wheat also lent support to US Chicago wheat futures.

Advertisement

Advertisement

2018/19 world wheat production is set to fall to a five-year low of 721Mt, following significant downgrades to crop prospects in Russia and the EU according to the International Grains Council.

EU wheat supply and demand forecasts had downward revisions in the latest EU crops market observatory 2018/19 production forecast. Usable EU wheat production is now forecast to be 142Mt for 2018/19, down over 4Mt from the 2018/19 June forecast and now more than 8.4Mt below the five year average (EU Commission).

UK delivered rapeseed prices rose markedly between Friday 20 and Friday 27 July. This was on the back of growing clarity over the extent of European rapeseed crop issues and global soyabean price rises. Tight logistics and spill over support from the grains complex were also potentially factors.

EU-28 rapeseed production is now expected to fall below 20Mt in 2018/19 by the EU Commission. Incorporating reduced yield forecasts from last Monday’s MARS crop monitoring report, the Commission cut its crop estimate by 1.2Mt to just 19.7Mt. This is 10% lower than 2017 and the lowest since 2012 (19.2Mt). The impact is expected to be partly offset by increased usage of soyabeans and sunflower seed but import levels will also be closely watched.