MI Northern Ireland Market Report

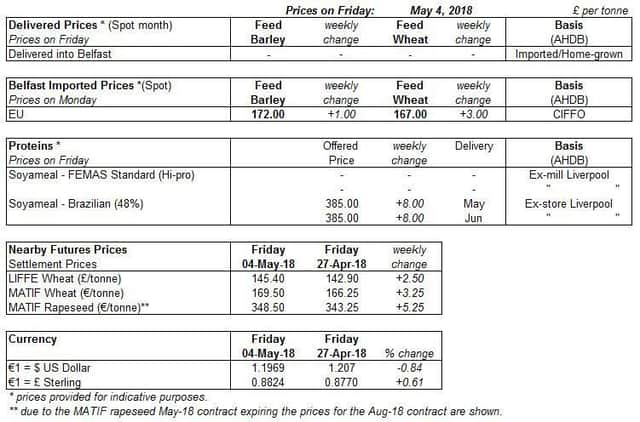

Global grain markets in general gained again last week (27 April – 4 May).

Wheat markets are still being influenced by concerns over the condition of US wheat crops. Meanwhile, downgraded forecasts for Brazilian maize production also lent support to global grain markets. UK new crop wheat futures (Nov-18) also saw a gain throughout the week, breaking above the £150.00/t mark.

Advertisement

Advertisement

The condition of winter wheat in the US continues to be reported as poor compared to recent years. In the latest USDA crop progress report for the week ending 6 May, the percentage of the winter wheat crop reported as very poor and poor is up 22 percentage points year on year, from 15% to 37%.

According to an UkrAgroConsult forecast, Ukraine’s total barley area for the 2018 harvest will shrink by 9%. UkrAgroConsult estimates that roughly 100Kha of the earmarked area (6-7%) will not be sown to spring barley, owing to an abrupt temperature increase.

The latest cereals usage data, published 3 May by AHDB, revealed that 2017/18 barley usage in GB animal feed production was up 20.9% year on year, as at end March 2018. For Human and Industrial (H&I) usage in 2017/18, the volume of wheat milled (including starch and bioethanol) was down 4.6% on the year, at 5.11Mt as at end March.

Oilseed markets diverged last week (Fri 27 Apr – Fri 4 May) as Paris rapeseed futures rose, while Chicago soyabean prices edged slightly lower. One of the main drivers was the rise in the strength of the US dollar against most currencies, including the euro and pound. This weighed on US prices and at the same time supported European values. Rising crude prices and continuing trade tensions between the US and China are also likely to have been factors.

Chicago soyabean futures closed sharply lower on Monday (7 May), after good planting progress in the US and further dollar strengthening. Rapeseed futures followed suit.