MI Northern Ireland Market Report

Global grain markets recorded mixed movements last week (Friday-Friday).

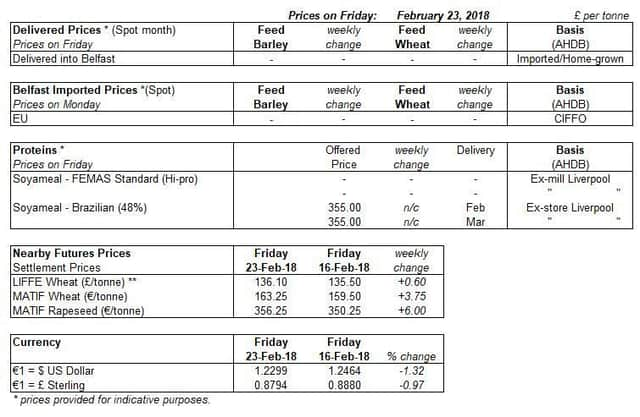

Both UK and Paris wheat futures (May-18) gained on the week on cold weather concerns. Conversely, both Chicago wheat and maize futures fell slightly. Meanwhile, oilseed prices increased week on week as at last Friday, with Argentine soyabeans continuing to grab the headlines.

Advertisement

Advertisement

Winter wheat across large swathes of western and southern Europe could be at risk of winter kill if a severe frost strikes according to the latest EU MARS crop bulletin, released 19 February. The milder weather across most of Europe has restricted the acclimatisation of winter cereals to low temperatures.

Planting of the Safrinha maize crop in Brazil’s second-largest grain producing region, Mato Grosso, is far behind last year’s pace, according to Brazilian research body, Deral. As of 22 February, 16% of the expected area had been planted, compared to 48% at this time last year. Mato Grosso has been heavily impacted by wetter than normal weather in recent weeks, which has delayed the soyabean harvest, pushing back maize planting. This elevates risks to crops of the drier and colder weather forecast.

On Thursday, the USDA projected the U.S wheat planted area for 2018/19 at 18.8Mha, up 0.2Mha from the previous year. Meanwhile, the estimated maize planted area has been projected at 36.4Mha, 0.1Mha lower than 2017.

The latest grain market report from the International Grain Council provided preliminary prospects for the 2018/19 maize crop. The US harvested area has been estimated at 33.2Mha, a three-season low. Meanwhile, the projected harvested area in Brazil is 17.3Mha, up 4.5% on last year.

Advertisement

Advertisement

The Buenos Aires Grain Exchange reduced its estimate of 2017/18 Argentine soyabean production further last week as drought conditions linger. The current forecast is 47Mt, down from the previous forecast of 50Mt (as at 14 February) and 10.5Mt below 2016/17 production levels. The Rosario Exchange has also cut its output forecast for this season’s Argentine soyabean crop, to 46.5Mt from 52Mt. As no substantial rainfall is forecast in the coming weeks, production estimates could drop further still.

At its Annual Agricultural Outlook Forum, the USDA has projected 2018 US soyabean plantings at 36.4Mha, slightly lower than last year’s planted area (36.5Mha). US maize plantings in 2018 are also projected at 36.4Mha. With US maize plantings expected to get underway next month, followed by soyabean plantings in May, it will be interesting to see if soyabeans can take the mantle of top US crop from maize this season.