MI Northern Ireland Market Report

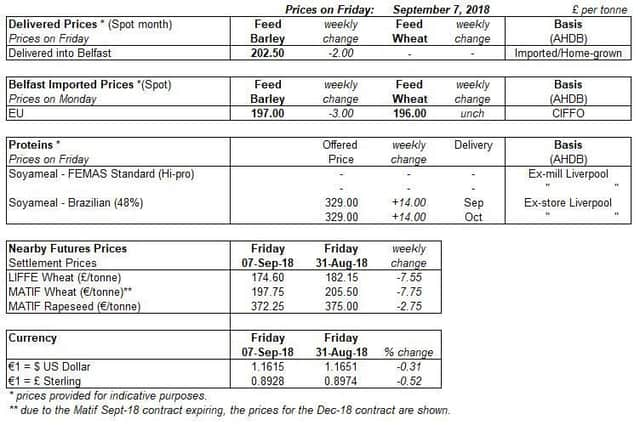

Chicago, Paris and London wheat futures (Dec-18/ Nov-18) all declined last week, with the bulls coming from Russian export news fading.

Additonal information from the Australian crop report (11 Sept) and the WASDE (12 Sept) will be watched closely. GB physical grain prices slumped last week following Vivergo Fuels’ announcement of a proposed closure.

Advertisement

Advertisement

Vivergo Fuels proposed to cease production of bioethanol from the end of September on Thursday. Markets originally acted in a bearish manner, although the true impact on the market will be borne out over time.

The Russian Agriculture Ministry announced on Thursday that it will not introduce duties on the export of wheat, at this moment in time. In response the sentiment of global grain markets reversed. Russian production in 2018/19 (68Mt, USDA, as at 10 September) is forecast for its first decline since 2012/13. While the picture for Russian trade is foggy, any news will be important to market sentiment.

Last week US soyabean futures (Nov-18) dipped midweek before recovering to close slightly up on the previous Friday, due in part to weakening in the US dollar. Meanwhile, Paris rapeseed futures (Nov-18) fell on the week with a strengthening in the value of the euro.

Canadian canola (rapeseed) stocks at the end of July 2018 were pegged at 2.39Mt, 1.05Mt above stocks in July 2017 (Statistics Canada). It is worth noting that while stocks remain high, dryness continues to impact the Canadian canola crop. The latest estimate places production at 19.2Mt in 2018, at fall of almost 2.2Mt from 2017.

Advertisement

Advertisement

The Argentinian government increased the export duty on soyabeans and their derivatives on 3 September. The duty will result in an actual tax increase of around 3%, despite an export tax reduction on the commodities, to 18%.