Don’t miss this vital deadline if you claim High Income Child Benefit

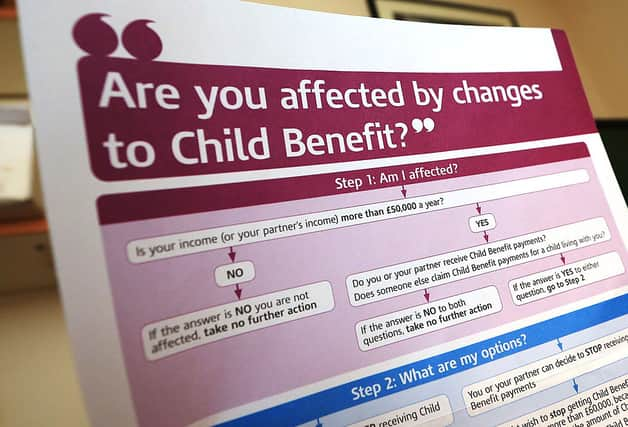

People who fall into the ‘high income’ category for receiving child benefit need to take action now if they want to avoid filling out forms for HMRC.

If your household income is over £50,000 and you received child benefits over the 2018/2019 tax year, you have until Saturday 5 October 2019 to notify HMRC and avoid having to complete a self-assessment form.

Advertisement

Advertisement

This is because of the complicated rules surrounding child benefit for high earners that were put into place by then-chancellor George Osbourne in 2013.

The changes saw the benefit scrapped for anybody earning more than £60,000 a year, and reduced for those earning between £50,000 and £60,000.

Who needs to pay the money back?

The rules are complicated, however, for people at the threshold.

If two parents earn £49,000 each (a total of £98,000 between them), they are eligible for the benefit. But if one parent earns £60,000 and the other nothing, they cannot.

Advertisement

Advertisement

This means that families that earn above the threshold for either reduced benefits (£50,000) or are ruled out of any benefit at all (£60,000) collectively, but individually earned less and so still could claim, need to repay part or all of the money they were given.

This is typically at 1 per cent for every £100 earned over £50,000, and 100 per cent once you earn over £60,000.

If you let HMRC know that you earn more than £50,000 before 5 October, then you will ensure that you get the correct tax code. If you do not, you will have to file a tax return and pay any extra money you claimed back in January.

You can find out more by going to the HMRC website.